IRS Imposes New Reporting Standards for DeFi Platforms in the US Crypto Sector

by aria-crypto.com

December 28, 2024 at 07:34

IRS Imposes New Reporting Standards for DeFi Platforms in the US Crypto Sector

The U.S. Internal Revenue Service (IRS) has released new regulatory guidelines for decentralized finance (DeFi) platforms, categorizing them as brokers under U.S tax laws. Starting in 2027, these platforms must collect extensive know-your-customer (KYC) details during customer onboarding, akin to traditional centralized exchanges. They are also required to track and report all customer transactions and trading income using Form 1099-DAs. This policy shift aims at enhancing transparency and compliance in cryptocurrency transactions, smoothing the process of tax collection for digital asset transactions. Service providers facilitating user interactions on DeFi platforms will need to comply with these rules, ensuring that customer and transaction data are meticulously reported to the IRS. The new rules have sparked significant discussion within the DeFi community, with concerns over the implications for operational frameworks and user privacy. Nevertheless, the IRS indicates that brokers who make a "good-faith effort" to adhere to these rules may receive penalty relief for specific transactions in 2027 and certain sales in 2028. While these regulations impose stringent reporting and transparency requirements, they symbolize a concerted effort to align crypto tax law enforcement with traditional financial regulations, possibly reshaping the landscape of DeFi operations in the U.S. The overarching goal is to close tax loopholes and ensure equitable taxation across all platforms, maintaining the integrity of the financial market.

Most Read

No articles to show at the moment

Read more

>> Japan Remains Cautious: Bitcoin's Role in Future Economic Strategies

Recent reports have highlighted the Japanese government's cautious stance toward incorporating Bitcoin into its monetary reserves. Despite advocacies by certain lawmakers, Prime Minister Shigeru Ishiba expresse...

>> US Spotlight: Robust Inflows and Strategic Reserves Shape Bitcoin's Dynamic Market

United States-listed spot Bitcoin and Ether exchange-traded funds (ETFs) experienced a remarkable year with a combined $38.3 billion in net inflows. Leading the way, the iShares Bitcoin Trust ETF secured $37.3...

>> Judge, SEC, and Ripple: Analyzing the Controversial Rulings and Regulatory Scrutiny

Charlie Gasparino, a noted columnist and FOX Business Senior Correspondent, has vocally criticized the SEC's regulatory actions against Ripple and its cryptocurrency, XRP. He described the regulation as unnece...

>> China's Strategy Shift: Is Bitcoin's Ban Coming to an End?

Look, it seems inevitable that China might lift its Bitcoin ban soon, given the explosive global momentum of Bitcoin and increasing interest from major political figures. Despite the 2021 trading and mining ban...

>> South Korea's Intensified Crypto Oversight Amid Surging Investor Numbers and North Korean Threats

The South Korean government has imposed sanctions on 15 North Koreans connected to cyber heists intended to fund North Korea's weapons program. These individuals reportedly operate within IT sectors globally, e...

>> IRS Clarifies Broker Status for Digital Asset Platforms in New Regulations

The United States Internal Revenue Service (IRS) has unveiled new regulations that require brokers, including decentralized exchanges, to report digital asset transactions. Set to be enforced starting in 2027, ...

>> EU Regulation Uncertainty Threatens Tether Stability and Exchange Compliance

The impending activation of the EU's Markets in Crypto-Assets (MiCA) regulation raises significant concerns about compliance for cryptocurrencies, particularly Tether's USDt. Coinbase has already delisted USDt ...

>> Cambodia's Central Bank Endorses Stablecoin Use, Shuns Traditional Cryptocurrencies

The National Bank of Cambodia has recently issued a directive that permits the operation of stablecoin services while simultaneously banning cryptocurrencies without any backing, such as Bitcoin. This decision ...

>> Russia Turns to Bitcoin for International Trade Amid Sanctions

Recent reports highlight that Russian companies are now using Bitcoin and other cryptocurrencies to circumvent international sanctions. The country's embrace of digital currencies for international trade follow...

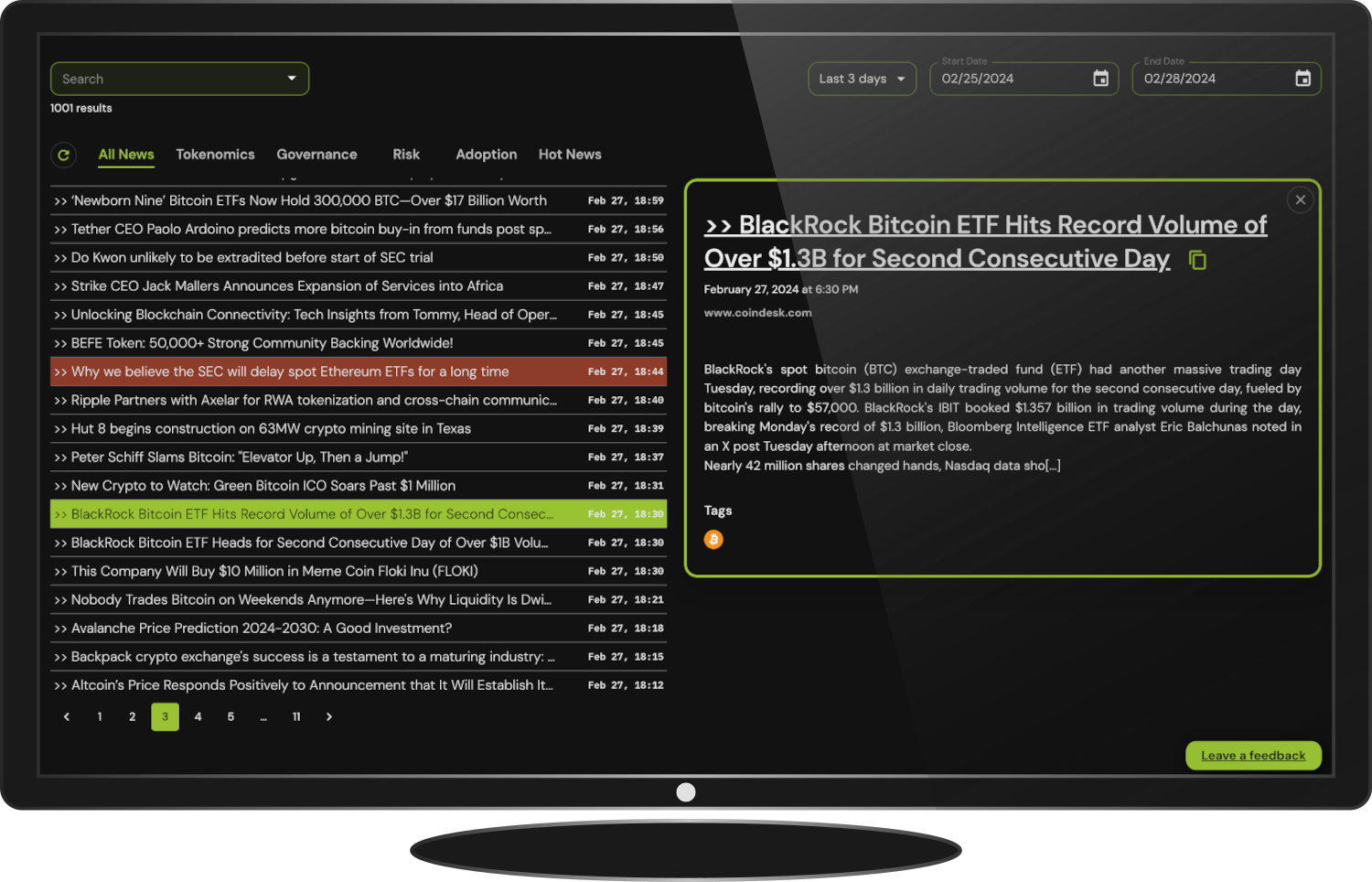

All the latest crypto news in one place

Stay informed and up-to-date on the market's latest news with our Terminal's News Aggregator with curated news articles and analysis from over 50 sources, including the crypto's biggest publications.

Launch Terminal