by aria-crypto.com

May 2, 2025 at 17:42

IRS and SEC Collaborate for Simpler Crypto Regulations: A Promising Future Ahead

The U.S. Securities and Exchange Commission (SEC) is preparing to ease regulations surrounding cryptocurrencies by learning from the Internal Revenue Service (IRS).

Recent proposals from industry leaders like Coinbase advocate for clearer guidelines and a potential reimbursement policy for legal expenses related to SEC enforcement actions.

This shift towards cooperation marks a significant departure from the SEC's historically adversarial stance, reflecting broader governmental support for the crypto sector.

As the SEC considers a new approach, including insights from the IRS, the hope is for clearer pathways to compliance that encourage growth and innovation in the industry.

The recognition of a need for proactive guidance instead of reactive enforcement may alleviate the legal uncertainties currently faced by crypto firms.

Innovative financial products, including anticipated Exchange-Traded Funds (ETFs) for popular cryptocurrencies, could reshape market dynamics and attract new investments.

Recent market signals, including Bitcoin's growing stability and heightened interest in altcoins, indicate that investors are responding positively to this changing landscape.

Moreover, Tether's initiative to launch a Bitcoin-based stablecoin demonstrates the industry's push towards regulatory alignment and safer trading environments.

With ongoing calls for a comprehensive legislative framework, collaboration between the SEC, IRS, and Treasury could streamline compliance for digital asset companies.

As these regulatory reforms progress, the future for cryptocurrencies looks increasingly promising, paving the way for a more structured financial ecosystem.

No articles to show at the moment

Ripple has achieved a significant regulatory milestone in the United Arab Emirates by becoming the first blockchain-powered payments company to secure a license from the Dubai Financial Services Authority (DFSA...

The UK's Financial Conduct Authority (FCA) has proposed a significant regulatory measure aimed at banning the purchase of cryptocurrencies with borrowed funds, including credit cards. This initiative stems fro...

The European Union (EU) has introduced a transformative regulatory approach to cryptocurrency by banning anonymous accounts and privacy coins by 2027. This move is part of a comprehensive Anti-Money Laundering...

Bitcoin has reached a new 10-week high, surpassing $97,000, following stronger-than-expected US labor market data. The Department of Labor reported that 177,000 jobs were added in April, exceeding the forecast...

On May 2, 2025, Ripple's Executive Chairman Chris Larsen will meet with SEC Chair Paul Atkins, a development that may influence the long-running case between Ripple and the SEC. Atkins' appointment has reignit...

KuCoin, the cryptocurrency exchange, is making strides towards reentering the South Korean market after previously facing restrictions. In March, South Korean regulators mandated the blocking of non-compliant ...

Tokyo-based Metaplanet is making headlines with its recent issuance of ¥3.6 billion (approximately $24.8 million) in bonds aimed at expanding its Bitcoin holdings to over 5,000 BTC. These zero-interest bonds w...

Investment advisory firm Two Prime has made headlines with its unprecedented decision to sell all Ethereum holdings and shift its entire focus to Bitcoin. As an SEC-approved entity, Two Prime's pivot emphasize...

Morgan Stanley is progressing towards launching cryptocurrency trading services, aiming to incorporate digital assets into its E-Trade platform. Reports suggest that this venture will begin as early as next ye...

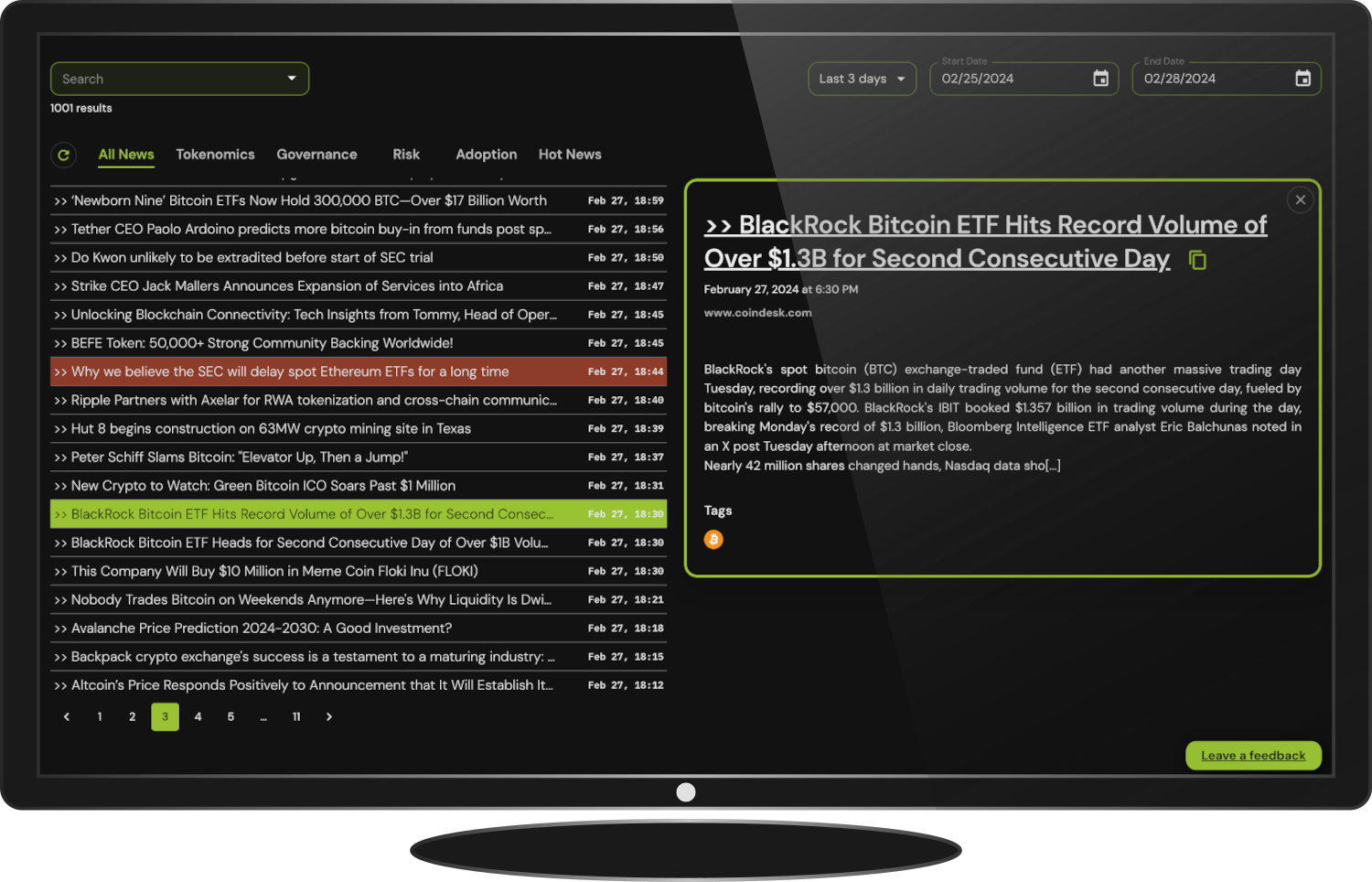

Stay informed and up-to-date on the market's latest news with ARIA's Institutional Terminal's News Aggregator.

Find your curated news articles and analysis from over 50 sources, including the crypto's biggest publications.

Get Institutional Access