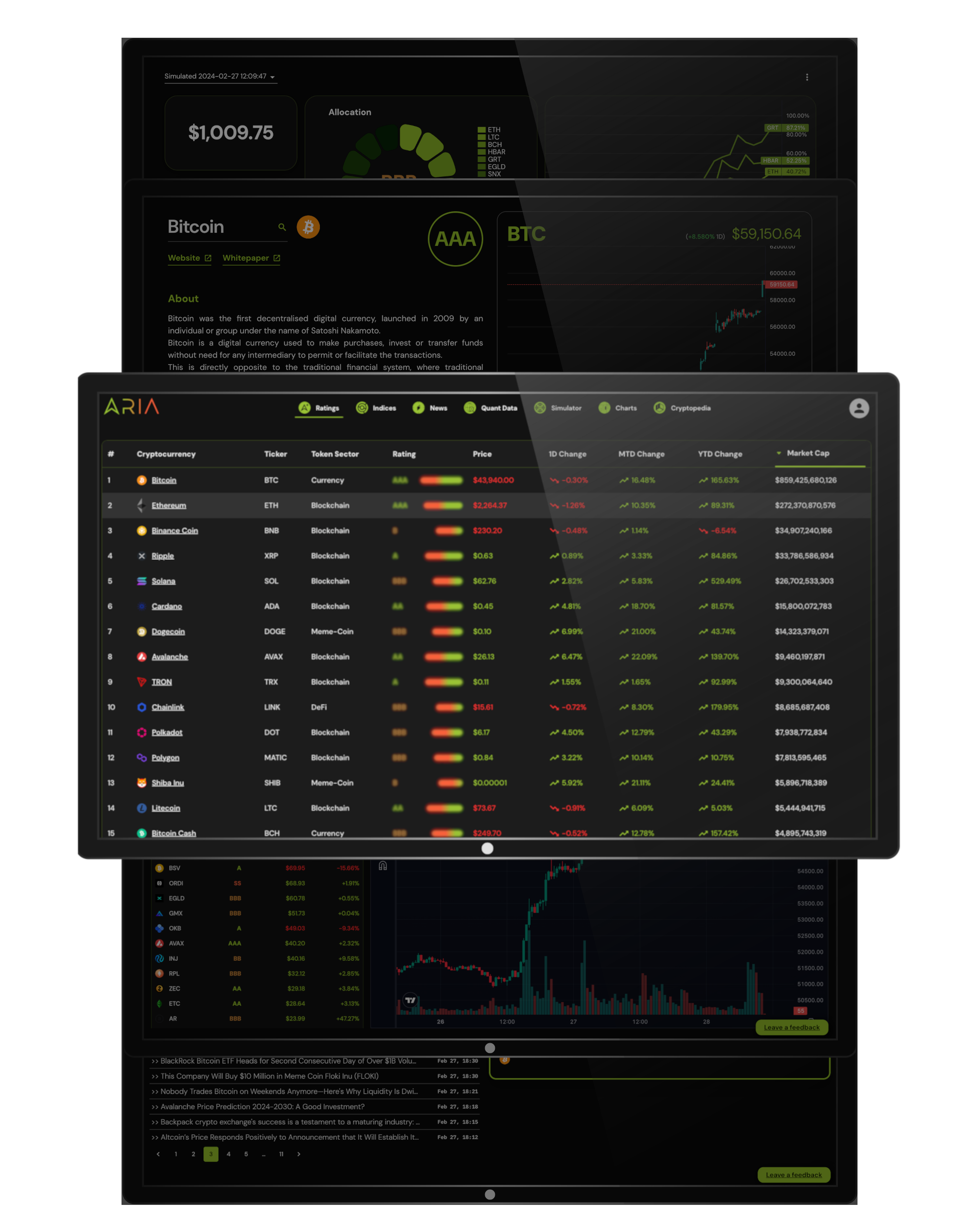

Crypto markets are complex, fast-moving, and largely unstandardised. For institutions, that means opaque risk, fragmented data, and limited defensibility in decision-making.

ARIA changes that.

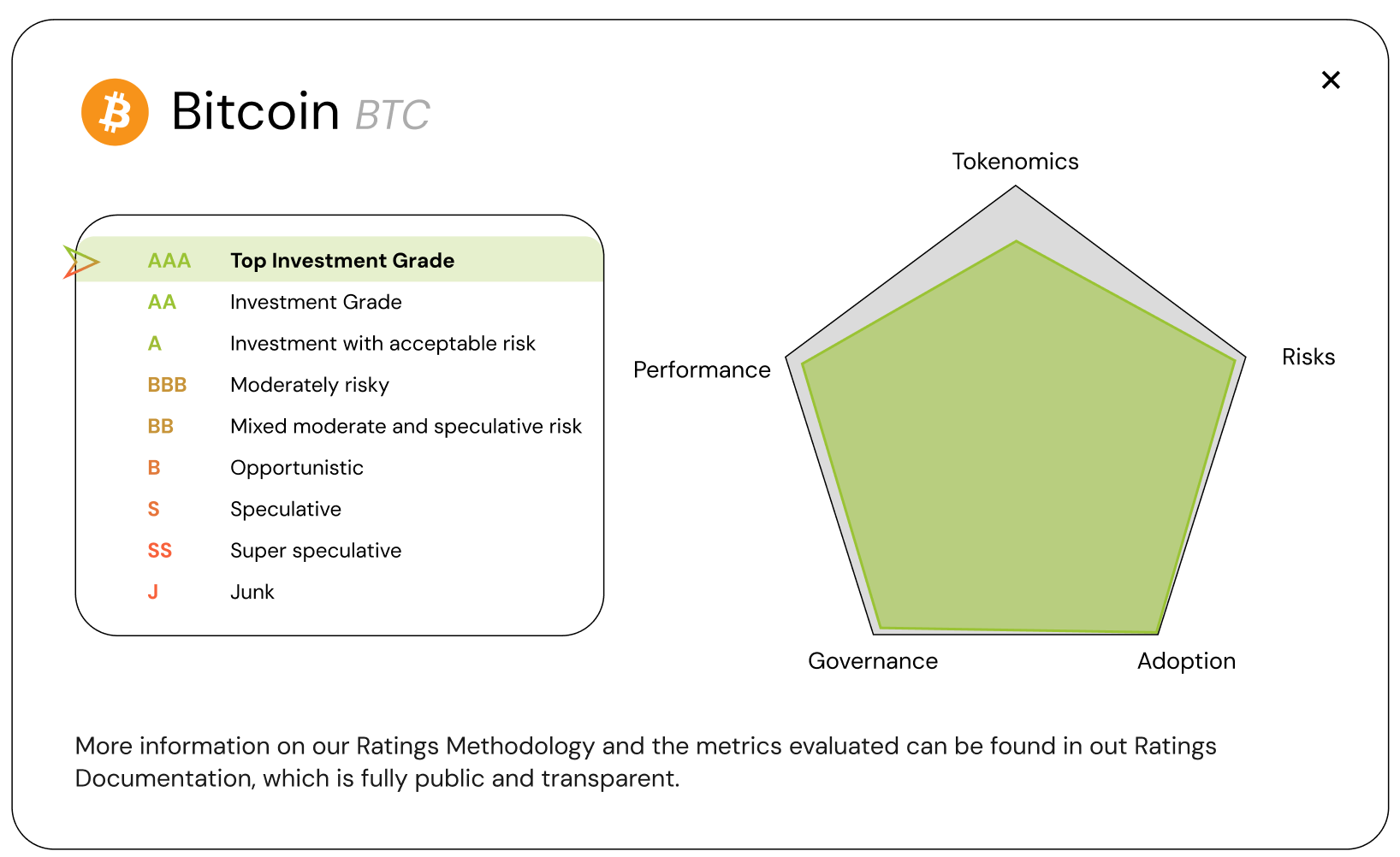

ARIA's risk ratings are built on a proprietary quantitative model that scores digital assets across multiple risk dimensions—integrating notably financial health, tokenomics, governance, market behaviour and trends, security risk.

The result? A structured, defensible, and compliance-aligned rating that helps institutions act with clarity and confidence.

Our ratings are generated using a scoring algorithm designed to provide a near-real-time snapshot of the global risk health for over 250 digital assets, through a combination of advanced mathematical models, reliable data sources and and fair, expert analysis.

• Transparent multi-criteria methodology spanning over 35 risk metrics including financial performance, governance, security & legal risk, adoption and tokenomics

• Rating Scale spanning 9 ratings, ranging from AAA Top Investment Grade to J Junk

• Automated ratings process, eliminating human bias in crypto risk assessments

• Tailored delivery system (Direct API feed, Custom framework integration, Institutional Terminal GUI access)

Monitor portfolio risk with transparent scores

Standardize due diligence across teams

Support allocation and rebalancing decisions

Build a structured listing/delisting framework using ratings

Provide clients with asset-level risk transparency

Enable better compliance documentation

Integrate into crypto asset classification schemes

Use ratings as one factor in building eligibility or supervision frameworks

Inform policy or sandbox initiatives with real-world data

ARIA Ratings is a comprehensive rating system that evaluates the performance, the potential and the risk profile of various cryptocurrencies. Our team of experts have designed a systematic approach to ratings that analyzes market trends, technology and other factors to provide accurate, reliable and daily updated ratings.

Our Ratings are available via API, within a custom risk framework integration or via our Institutional Terminal GUI. Contact us now to speak to a member of our team and we will find the best solution that fits your needs and technology.

Our ratings are determined through a rigorous evaluation process that takes into account various factors such as market performance, technology, governance, market trends and adoption, as well as other factors. Our team of experts have carefully designed ARIA Ratings to assess each cryptocurrency in the most accurate and unbiased manner.

Read more about our Ratings Methodology in our Documentation page.

Yes, you can trust in the reliability of our ratings.

We pride ourself on providing reliable information in a fully transparent process, which is why we have published the full list of metrics incorporated into ARIA Ratings in our product's Documentation. Furthermore, all metrics taken into account by ARIA's Ratings algorithm rely on publicly available and verifiable information. Our team of experts conducted extensive research and analysis in the development of ARIA Ratings to ensure the accuracy and credibility of our ratings.

ARIA Ratings are updated daily to reflect the latest market trends and developments. We strive to provide up-to-date information to our users, ensuring that they have access to the most accurate ratings.

ARIA Ratings publishes daily ratings for all cryptocurrencies that have been in circulation at least 3 months and that have a market capitalisation of at least 500 million USD.

In the event a crypto asset that has been added to ARIA's scope falls below the 500 million USD threshold, the algorithm will continue to rate it.

Due to their specific nature, the ratings of stablecoins would require access to private information (e.g. the project's reserves backing the stablecoin). ARIA only utilises publicly available and verifiable information and therefore does not include the rating of stablecoins in its scope at present.