Asset managers today are expected to deliver more than exposure—they must offer structure, explainability, and alignment with evolving regulatory and institutional standards.

Whether you're designing a passive ETF, launching a model portfolio, or building your first crypto product line, your edge lies in the quality of the index and the strength of the risk logic behind it.

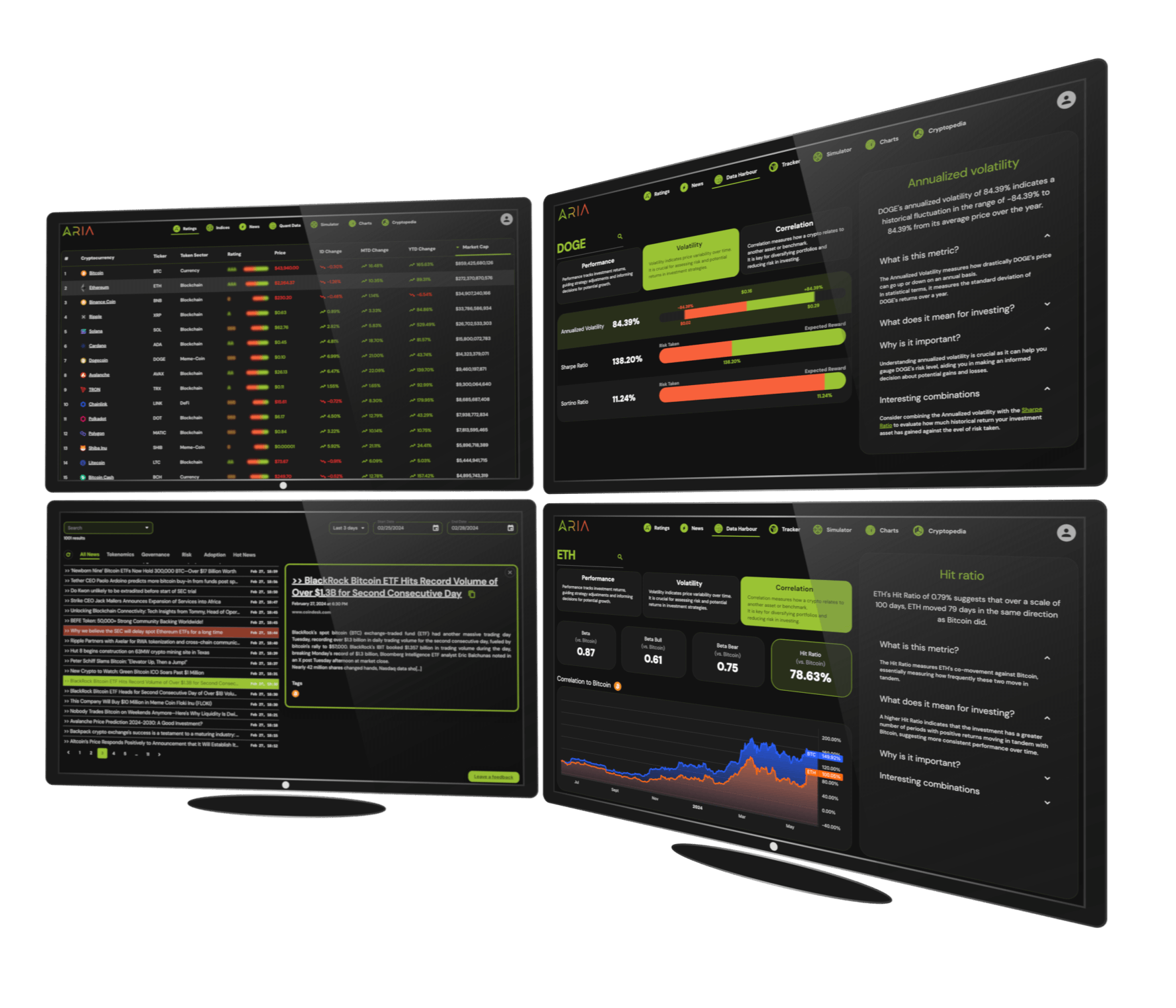

ARIA helps you:

With ARIA, your digital asset products don’t just follow markets—they lead with structure.

Move beyond market-cap benchmarks with custom indices built on risk-weighted methodologies, thematic filters, or compliance screens.

Use ARIA’s ratings, whitelisting frameworks, and methodology support to bring investment products to market that meet internal and regulatory standards.

Back every inclusion, exclusion, and rebalancing decision with transparent, data-driven rationale—ready for investor, board, and regulator review.

Whether launching a passive ETF or building an internal benchmark, ARIA designs transparent, risk-structured indices tailored to institutional mandates. We act as your index partner—offering both data licensing (for in-house teams) and full index engineering & calculation services.

ARIA’s algorithmic risk scores offer a quantitative foundation for portfolio construction, asset onboarding, and governance alignment. Unlike sentiment-based tools, our ratings are designed to integrate with institutional investment processes—supporting due diligence, risk-adjusted exposure, and internal reporting.

We help managers codify internal risk rules and automate oversight—enabling you to define which tokens are eligible for custody, investment, or index inclusion. Our frameworks ensure policy adherence and reduce decision-making ambiguity.