As digital asset markets grow in complexity and scale, regulators need tools to assess, monitor, and govern them—without relying on fragmented, unverified information. Internal capacity is often stretched, and frameworks must be both defensible and adaptable.

ARIA acts as a neutral, institutional-grade risk intelligence partner—helping regulatory bodies translate their policy goals into operational, data-driven frameworks for whitelisting, asset monitoring, and risk governance.

Whether you're structuring an eligibility system, a sandbox framework, or market-wide supervision tools, ARIA brings the technology, metrics, and expertise to support confident regulatory action.

Transform high-level policy into enforceable, transparent governance structures using ARIA's metrics, risk logic, and modelisation tools.

Develop, test, and deploy real-time eligibility frameworks based on customisable criteria like risk scores, liquidity, volatility and governance.

Use automated scoring and compliance monitoring to stay informed of protocol changes, market events, or asset-level red flags—before they escalate.

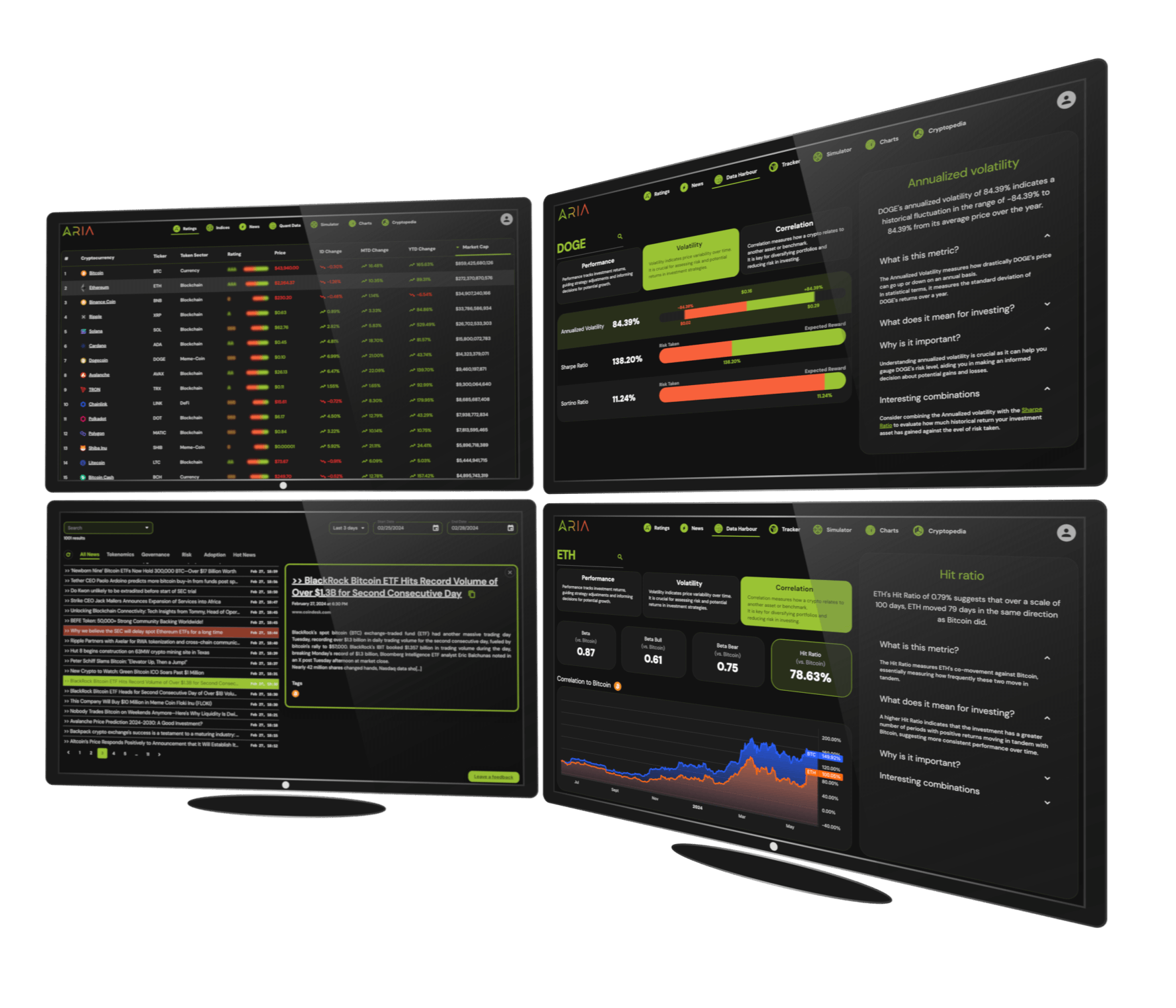

Independent, algorithmic scoring of individual crypto assets based on financial, governance, and market risk factors. Used to classify assets, define thresholds, and monitor ongoing market integrity.

Custom-built eligibility systems based on regulator-defined parameters. Fully modular, simulation-tested, and integrated into dashboards or APIs.

Daily compliance updates, real-time alerts, and visual dashboards to supervise the asset universe and flag non-compliant behaviour.