Whether you're onboarding tokens, launching an index-based product, or expanding institutional services, the stakes are the same: credibility, compliance, and control.

With increasing regulatory scrutiny and institutional client demand, exchanges need more than access—they need structure, transparency, and oversight.

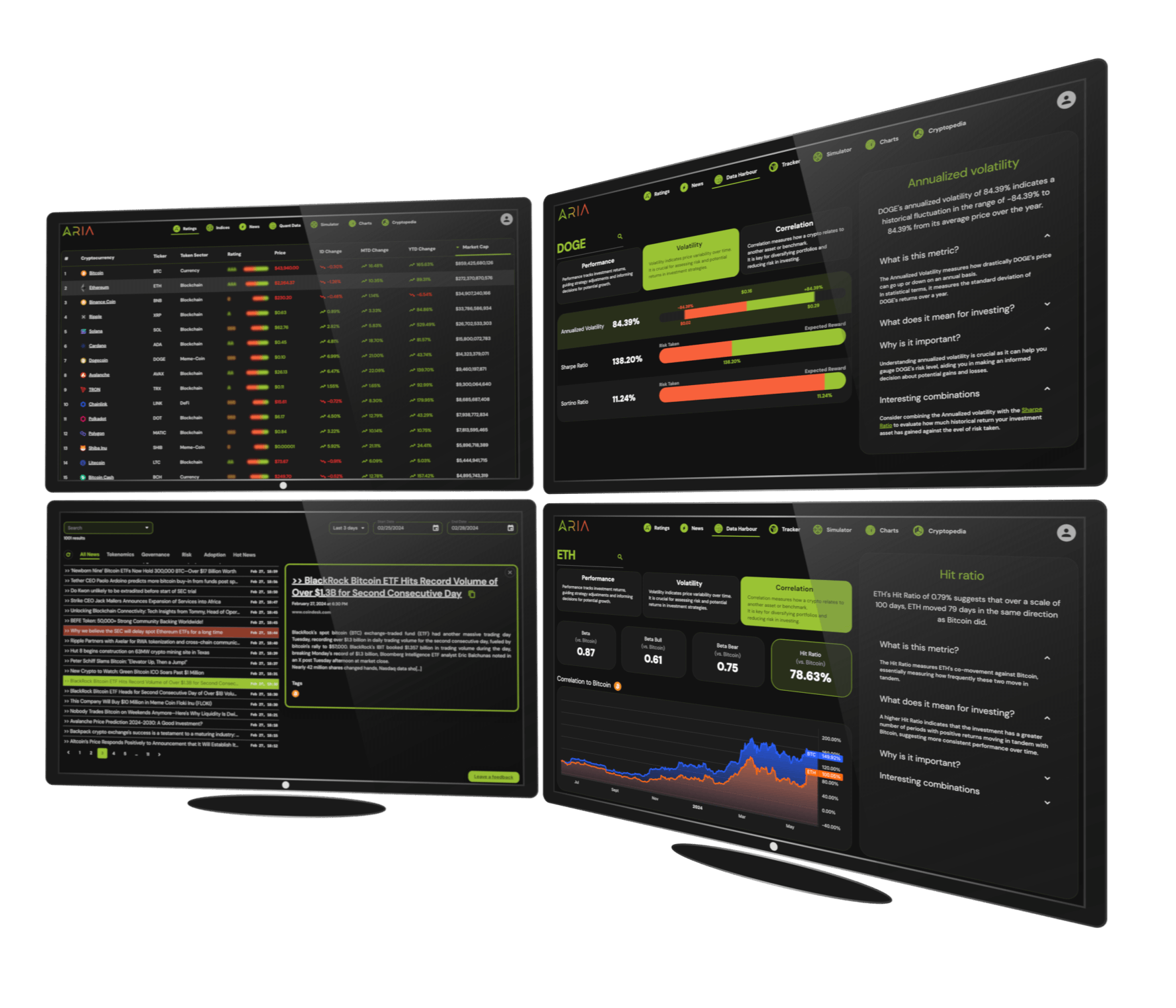

ARIA helps exchanges operate with confidence, by embedding independent risk intelligence into your listing, governance, and product infrastructure.

Use ARIA's risk ratings and frameworks to screen, monitor, and flag assets—bringing discipline to onboarding, delisting, and asset risk profiling.

Offer Crypto Tradable Indices (CTIs), structured notes, or derivatives based on ARIA-powered indices—compliant, rules-based, and auditable.

Equip your exchange with automated tools, compliance dashboards, and risk alerts—tailored for regulatory alignment and investor trust.

Score assets objectively using ARIA’s multi-factor risk model. Used for listings, risk disclosures, and internal governance.

Launch CTIs, ETPs, or structured products with indices engineered and calculated by ARIA. Includes thematic, custom, and risk-screened indices.

Codify and enforce listing criteria based on asset liquidity, governance, and ARIA risk scores. Delivered via dashboard or API.

Real-time compliance dashboards, daily asset updates, and proactive flagging of tokens that fall out of risk tolerance.